Ever wonder how other people spend their money?

In our society it sometimes feels like people will talk about anything and everything. All kinds of topics – from the sublime to the ridiculous – are covered in TV programmes . . . social media . . . overheard conversations in the pub. It really does seem like nothing is taboo any more.

Except money!

Whilst some people do talk about money, it is still one thing that many of us are reluctant to talk about. For example, think of your friends and family. Do you know how much they earn, whether they have debts or savings, and how they spend their money?

The way people spend money is particularly relevant. Each month we start off with money in our bank account and lots of good intentions, but often by the end of it all that money has gone. And we don’t really know where. Is it like that for everyone? Or are we just spending more than other people?

In this article we look at how the average UK household spends their money, and ways that you can start to get on top of your own spending.

How does the average UK household spend their money?

Every couple of years the ONS (Office for National Statistics) conducts a Living Costs and Food Survey. This enables them to analyse the typical monthly expenditure of a UK household.

The latest data – for the financial year ending in March 2020 – is based on 4,928 UK households, with an average of 2.4 people in each household. It reveals that the average UK household spending is £2,548 a month.

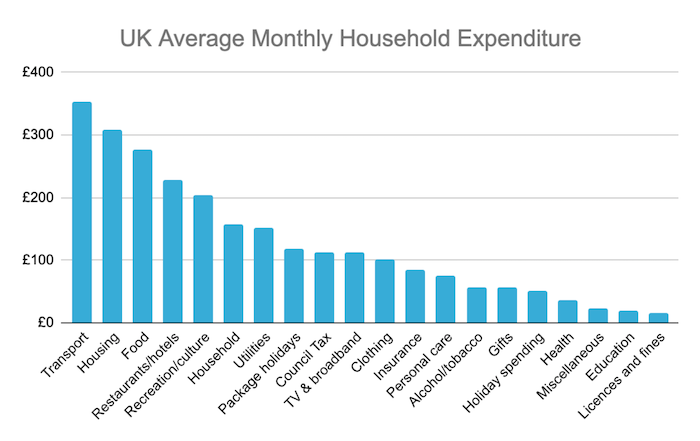

This breaks down as shown in the chart below.

The largest five items of expenditure for most households are:

1. Transport – £354

It may initially seem surprising that transport costs are so high, but this covers all types of transport used by the household, including:

- Car purchase;

- Car repairs and maintenance;

- Car parking;

- Fuel;

- Season tickets for public transport;

- Any other kinds of transport.

2. Housing – £309

Whilst this is second on the list in the above chart, for many people it is their top item of spending. The above figure of £309 is an average of all types of households surveyed, which included some with no mortgage or rent.

The figure also includes home repairs and maintenance.

So for many people the housing figure would be much higher than this and is likely to be their greatest expense.

3. Food – £276

The figure for food may seem a little low, but is based on 2.4 people per household. So if your household is larger than this you can increase the amount accordingly to see if your spending is roughly in line with the average.

4. Restaurants and hotels – £229

This covers all expenditure on going out or taking a break. For example:

- Meals in restaurants, pubs or cafes;

- Drinks in pubs;

- Takeaway meals at home;

- Accommodation in hotels or self-catering.

5. Recreation and culture – £205

This includes expenditure on a variety of recreational things that you enjoy. For example:

- Computers and other devices;

- Software;

- TV and audio equipment;

- Equipment for other hobbies eg sports, photographic, musical instruments;

- Gym and club membership;

- Garden equipment and furniture;

- Pets.

So these are the major areas of expenditure in a typical UK household. But how does yours compare?

We mentioned earlier the mystery of where your money goes each month. The only way to know that for certain is to make a budget of what you think you spend, then take at least a couple of months to test that out and see how realistic it actually is.

Let’s take a look.

How to get on top of your spending

There are three stages to this process:

- Make a budget;

- Track your spending;

- Adjust your budget to make ends meet;

Make a budget

By making a realistic monthly budget that includes all your income and expenditure you will be able to see where your money is going. A budget will also make it clear whether you have enough money for your needs, or are trying to live beyond your means.

You can create your budget however you like. For example write it in a notebook, use a computer spreadsheet, or use an app such as Money Dashboard, Emma or Yolt. You could also check with your bank to see if they have their own budgeting tools which you could link to your account.

Start by making a list of all your income and expenditure:

- Income is the money you know you have coming in. For example salaries, wages, allowances, benefits etc.

- Expenditure is everything you might spend money on. You can use the categories in the above chart to make sure that you are including everything and your budget is as accurate as possible.

Track your spending

Once you have your budget, you then need to track your spending. This is really important because your budget might look great in theory, but you may still end up in a mess at the end of each month.

So find a way to track your spending. Again, it doesn’t matter whether you use a notebook, spreadsheet, or app. Just do it.

Record absolutely everything you spend: even the smallest items can quickly add up. At the end of the month compare your actual spending with your original budget.

If you do this for two or three months running, you may realise that you are constantly overspending in one category. If this is the case, you then need to make a conscious decision about whether to continue doing that, and budget accordingly, or whether either your spending habits or level of income needs to change.

Adjust your budget to make ends meet

The purpose of budgeting is to ensure that your income is at least as much as your expenditure. Ideally you want to have some money left at the end of the month to enable you to build up some savings.

So if your budget and spending tracking reveals that you are not currently in this position, you need to find ways to either increase your income or reduce your expenditure. Or even both. We look at some ways to do this in our article Five ways to stay out of debt in 2021.

We hope that this article has given you some helpful information about how other households spend their money, and how to get your own spending gradually under control.

If you need a quick financial boost to start sorting out your finances, then perhaps a short term personal loan from Simple Fast Loans could help?

Check back here soon for more financial and lifestyle tips from Simple Fast Loans.